It would appear that the direction we predicted for Citroën on March 17 has become a reality with yesterday’s acknowledgement by CEO Linda Jackson, that Citroën will launch sales in India no later than the end of 2021. Jackson told Automotive News Europe that the India push will be led by design, lower-cost cars. “Citroën will listen to what Indian customers want rather than trying to impose European tastes on the market,” she said.

Citroën’s move into India is part of a strategy by parent PSA Group to reduce its dependence on sales in Europe. As part of that

Jackson stated that “Citroën’s models for India will be the first in the lower-cost range.” Although she declined to give further details, she did say that they would be “appropriate and relevant for the Indian customers.”

“All of the forecasts for India say the market is expanding exponentially,” Jackson said. Passenger car sales were about 3.6 million in 2018 and expected to grow to six million by 2025, which would make it the third-largest market after China and the United States.

Puneet Gupta, associate director of automotive forecasting at IHS Markit in India, feels that Citroën has a chance to succeed but that it is hard to compete with the top brands. “These brands understand the country very well, they can price their products very well, and they have a solid network base,” he said.

Still, there is room for new players as the market grows and space opens up for electrification, a government priority to reduce dependence on foreign oil, Gupta said. “That doesn’t mean that it will be a cakewalk; it will be very tough and challenging, but nevertheless there are real disruptions,” he said.

Anil Sharma, associate director for automotive and transportation at Marketsandmarkets Research, said India’s leading automakers were able to quickly respond to technical innovations, so Citroën would have to build “a strong and evenly spread product pipeline, and develop positive word of mouth through after-sales service.” “There is certainly some space left for new brands and OEMs in the Indian market,” he said. “However, a lot will depend on which segments it decides to play into as well as on its price, positioning, and sourcing strategies.”

“We need to have the mindset that we are going into India for Indians, and that’s why we have a local team that is defining exactly what should be in vehicles in terms of technology,” Jackson said. “It may sound a bit blunt. It’s an important point because there is sometimes an arrogance of Europeans that says, ‘I’ve been very successful in Europe, so I’m going to take exactly the same product and put it into India.’ Well, that’s not going to work.”

Sharma suggested that Citroën’s best chance is to focus on low-volume,

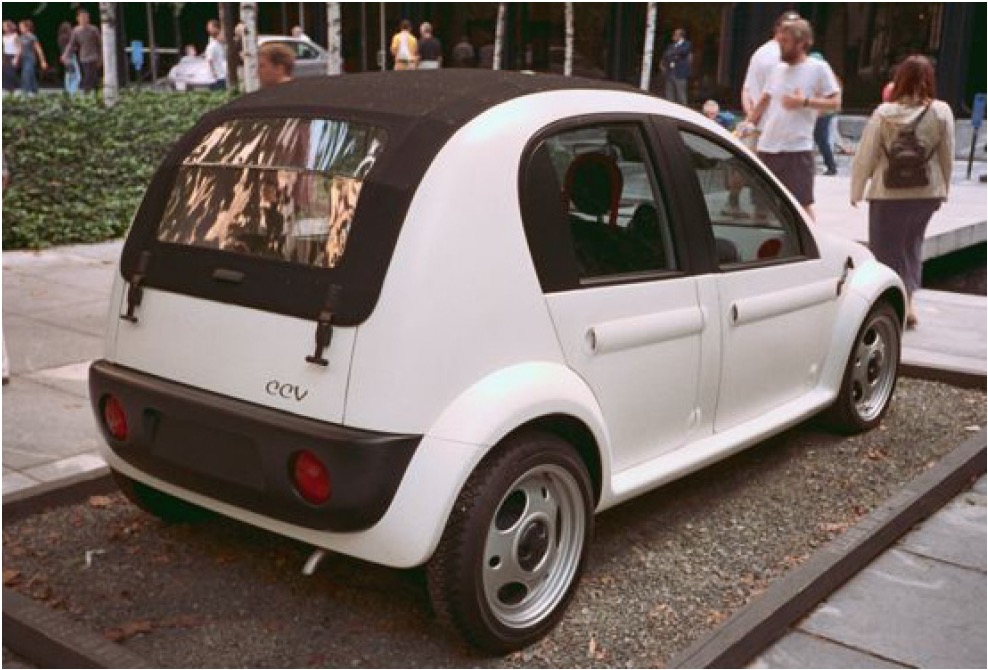

We agree with Sharma’s assessment. If Citroën does go the low-cost route, it will be interesting to see what they come up with. We harken back to the days when Chrysler tried to knock off the 2CV with their CCV (composite concept vehicle) to tackle the Asian market. (We featured it in articles in Citroënvie back in the Spring 2008 and Summer 2008 issues). The CCV was a concept that was innovative but so basic that Chrysler did not proceed with the project as China’s burgeoning prosperity at the time (1996) meant that soon those with income for an automobile would desire for something more upscale.

If for India, Citroën is looking to offer a low-cost contemporary 2CV-like vehicle, we wonder if perhaps something like the CCV, fitted with current electronic technology) would meet market needs?

IHS Markit projects annual growth in India to be 7 percent and a total passenger car and

Four brands — Maruti Suzuki, Tata, Hyundai and Mahindra currently have more than 80 percent of the Indian market, with the remaining 20 percent held by a mix of European, Asian and North American brands.

Jackson claims that Citroën will stand out with its design, as well as local production and a focus on initial quality and after-sales service “We think that Citroën’s unique styling offers something slightly different, and it could be a good way for us to have a faster impact on the market,” she said.

Citroën has stated that their cars for India will be built as part of two joint ventures that PSA set up in 2017 with CK Birla Group, one of which is a manufacturing partnership with Hindustan Motor Financing Corporation for the assembly and distribution of PSA vehicles in India. At the time of the announcement, PSA said it would produce up to 100,000 vehicles annually.

The other, Avtec Powertrain, has just started production of engines and gearboxes at a factory near Bangalore, with a capacity of 300,000 engines and 200,000 gearboxes annually.

At the Geneva auto show earlier this month, PSA CEO Carlos Tavares said the Avtec plant had just started exporting transmissions, and was “extremely, extremely profitable” and that the savings from producing in India had already made that joint venture self-sustaining.

PSA has tried in recent years to break into India. A joint venture with Premier to build Peugeot 309s from kits foundered in the late 1990s, as did a similar one with Tata to after-sales Peugeot 307s. A plan to invest 650 million euros in a factory in Gujarat fell apart in 2012 amid PSA Group’s financial issues.

As part of the CK Birla arrangement, PSA also acquired the rights to the Ambassador brand nameplate. The Ambassador was a Morris Oxford-based sedan produced for decades by Hindustan Motor, and more than half a million are still on Indian roads today, mostly as taxis.

Jackson said Citroën and PSA were considering whether and how to use the Ambassador name. “I want to be very careful how we use the name because you need to be credible when you use it and not just assume that everybody will say, ‘Yes,’ that’s a good idea.”

Whether the Ambassador name is used or not, the politics of Citroën taking on the India market within PSA will be a true test of the brand’s longevity. If successful, it could expand on what appears to be the “low tier” that PSA seems to be applying to the brand in existing markets today. If India sales are soft, then Citroën would be a prime target for brand reduction in PSA Group with the lower-end range of Peugeot models filling the void in the global market.

Update – April 12, 2019: Further to Citroën entering the India market here is an article written by Gautam Sen, acknowledged globally as a leading automotive journalist, writer, automotive design consultant and expert from India. He founded the country’s first newsstand car magazine Indian Auto in 1986, followed by Auto India, Auto Motor & Sports and BBC’s TopGear. Mr. Sen has also been directly involved with the automobile industry in India and

https://www.moneylife.in/article/another-chance-for-citroen-in-india/56847.html