PSA Peugeot Citroën reported a first-half operating loss of 510 million euros ($681 million), and a loss of market share in Europe to Volkswagen AG, the continent’s largest automaker. Over-reliance on the sagging European market has eroded PSA’s meagre profitability. Last year, it lost €5-billion and burned through €3-billion in cash.

PSA Peugeot Citroën August sales were down by more than 18% from the previous year, their lowest level since the European Auto Manufacturers’ Association began collecting records in 1990. And so in order to hedge off further massive losses, the company is in talks to raise funding from its Chinese auto manufacturing partner Dongfeng Motor Co. and the French government.

In a new funding model, Dongfeng Motor Co. and the French government would each contribute €1.5 billion giving each one between a 25 and 30% stake in the company. At the present time the Peugeot family owns 25.5 per cent of the equity and 38 per cent of the voting rights of the company, but this new investment would put the family in a minority position. Note as well that last year PSA Peugeot Citroën surrendered 9% of the company to an investment by General Motors.

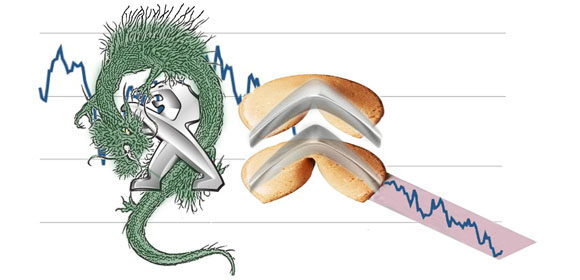

If this new investment strategy materializes, conflicting interests could fundamentally change the company going forward. Dongfeng Motor Co. currently operates three assembly plants in China with PSA Peugeot Citroën and would like to leverage both of the French brands in the growing Chinese market, not in in Europe where PSA Peugeot Citroën has been struggling. (A separate joint venture in China with Chang’An Automobile Group operates a fourth factory that opened in Shenzhen at the end of the September).

The French government, on the other hand, already exerts some influence on the company by having one seat on the board and guaranteeing €7-billion of PSA Peugeot Citroën bonds. It feels obligated to take a bigger stake in the company to protect jobs at home. But as they wrestle with the French economy and try to prevent the whole company from potentially sliding off-shore, what is going to become of this symbol of France’s waning industrial prowess?

Our fear for many years has been that waning sales in Europe would force PSA to consolidate its two marques and eliminate competing models to survive. With the Peugeot family in operational control we felt that if the choice came down to killing Peugeot or Citroën, Peugeot would be the brand to survive.

Alternately, a cash strapped French government might let PSA slip into Chinese control with a guarantee of protection for some French jobs. This could potentially threaten the two marques itself and put into jeopardy Citroën’s proud heritage.

Our prediction: Give it three years and Dongfeng Motor Co. will end up buying out the French government’s stake at a fraction of their initial investment, give the Peugeot family one last token return on a greatly diminished enterprise and ultimately own the majority of the company. Thus Dongfeng and General Motors (if they don’t fail along the way) will make France’s revered auto manufacturer appeal to a French car buyer the way a bottle of Shanghai Beaujolais would be savoured at a dinner in Paris.