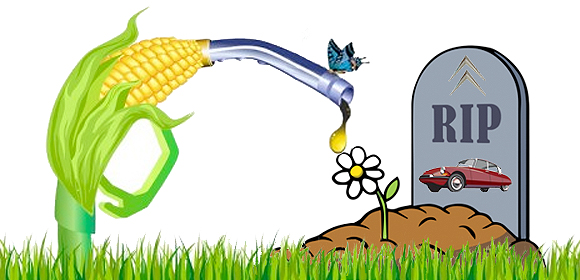

Citroën owners and classic car enthusiasts alike in Ontario, as the provincial government already has us “bent over and assuming the position” with respect to hydro pricing, their next move is to increase ethanol amounts in motor vehicle fuels. John Carlson, President & CEO of the National Association of the Automobile Clubs of Canada Corporation (NAACC) in British Columbia suggests in the following article, posted in the Financial Post on Dec. 22, 2017, taking the initiative and voicing your concern should your disagree with ethanol being added to motor vehicle fuels.

Special to Financial Post – December 20, 2017:

Ontarians will pay hundreds of millions of dollars for pointless new fuel standards

Ross McKitrick and Douglas Auld: “Ontario has jettisoned any pretense of economic logic in its climate policy mix.”

Ross McKitrick and Douglas Auld: “Ontario has jettisoned any pretense of economic logic in its climate policy mix.”

Ontario has announced plans to double the required content of ethanol in our gasoline, from five per cent to 10 per cent. This regrettable decision will have harmful effects on everyone. It will worsen the mileage of gasoline, raise food and fuel costs and yield minuscule environmental gains at best.

Ratcheting up the ethanol mandate also defeats the purpose of Ontario’s new cap-and-trade system. The logic of carbon pricing through permit trading is that it leads the market to identify and implement the lowest-cost ways of reducing greenhouse gas (GHG) emissions. If ethanol blending was cost-effective then, under cap and trade, fuel producers would do it automatically. The fact that they have to be coerced means it fails a cost-benefit test, making it precisely the kind of inefficient option the trading system is supposed to guard against. Forcing firms to do it anyway means Ontario has jettisoned any pretense of economic logic in its climate policy mix.

In earlier research we found that ethanol-subsidy programs during the 2008–12 interval cost Canadians over three dollars for every one dollar in social and environmental benefits achieved. The overt subsidy programs have largely been scaled back, but the blending mandates amount to a hidden subsidy, where the costs are transferred away from taxpayers onto industry and consumers.

It is highly misleading for the province to promote its policy as being equivalent to “taking up to 130,000 cars off the road.” Such statements only remind us how clean our cars have become. The policy itself yields tiny overall emission reductions, but since modern cars are so clean and efficient that translates into a lot of vehicles as an equivalent. By way of illustration, it would translate into taking an infinite number of bicycles off the road, since they emit nothing at all, but that is an equally uninformative comparison.

This regrettable decision will have harmful effects on everyone

The fact that modern cars are so clean actually signals how little an ethanol mandate will accomplish. It was shown over a decade ago that ethanol blending did nothing to reduce tailpipe emissions of carbon monoxide and hydrocarbons from cars built after 1988.

The only environmental benefit that proponents can point to is a potential reduction in greenhouse gas (GHG) emissions. We say “potential” because corn-growing and ethanol manufacturing both take energy, and on a life-cycle basis, ethanol GHGs can be higher than those from regular fuels, particularly in the U.S. where electricity production is still coal-intensive. Even assuming we get a net reduction in GHG emissions per litre from domestic production, the need for the mandate in the presence of carbon pricing shows that it is not enough to justify the additional manufacturing costs.

On the consumption side, ethanol producers claim that their product cuts GHG emissions by 62 per cent compared to gasoline. This is an almost impossible optimistic upper bound based on, among other things, using 100-per-cent ethanol. By contrast, Natural Resources Canada (NRCan) says a 10-per-cent corn-ethanol blend only cuts GHG emissions by three to four per cent.

Also according to NRCan, burning a litre of gasoline releases about 2.3 kilograms of carbon dioxide. A four-per-cent reduction is 0.09 kilogram per litre (0.00009 tonnes). At a value of $20 per tonne of carbon ($5.45 per tonne of carbon dioxide), the current social benefit of the emission reduction works out to five one-hundredths of a cent per litre.

In 2016, Ontarians used 16 billion litres of gasoline, so the GHG emission reductions from blending ethanol are worth, optimistically, about $8 million annually.

This is the number that needs to be compared against the social costs of increased fuel and food prices. As a point of comparison, one of the two Ontario ethanol plants has already spent $200 million to expand its production capabilities in anticipation of the new blending rule, indicating that it expects to take at least that much out of consumer pockets in the coming years. The other plant is also spending money to expand, and once we add in the increased food costs and the costs for refineries to accommodate the new rules we will likely find, as we did previously, that the costs are several times larger than the benefits.

The federal government is apparently also considering a higher national ethanol blending mandate. We hope that it will assess the costs and benefits more carefully than Queen’s Park did. If it does, it will find that such a move would be unjustified in the absence of its carbon-pricing policy, and completely irrational under it.

Ross McKitrick is a professor of economics at the University of Guelph and a senior fellow of the Fraser Institute. Douglas Auld is an adjunct professor of economics at the University of Guelph.

It should be noted that the National Association of the Automobile Clubs of Canada Corporation www.naacc.ca is also in complete disagreement with the Ontario Governments ethanol proposals. The NAACC through surveys has determined that, on average, collector vehicles are driven fewer than 400 miles per year. In British Columbia when Air Care was in effect, all post 1934 collector cars were required to go through an emissions test in order to be licensed. The outcome of those tests clearly indicated that collector cars could meet the AirCare requirements. The NAACC fully endorses the comments made by Mr. Ross Mckitrick above.

The NAACC does not support the increased fuel and food costs that are going to result from this ill conceived legislation. Further, the NAACC is quick to point out that this proposed fuel legislation is not only detrimental to ‘Collector’ vehicle fuel systems causing them to malfunction and in many cases forcing fuel delivery components to be completely replaced at a significant expense, but it also points out that many current farm vehicles will also be seriously affected because of fuel ‘phase separation’ and the deterioration of fuel pumps, carburetors and the deterioration of fuel tanks. Vehicle collectors and farmers and ordinary daily drivers who operate pre-2006 vehicles will now have to resort to purchasing higher octane ethanol free fuels at significantly higher prices and will also have to spend hundreds of dollars upgrading their equipment.

Ironically, this ill conceived legislation will not impact or reduce emissions.

And as bad as ethanol is for our classic cars, it is absolutely DEADLY for any small engines, even new ones. If you want your lawnmower, lawn tractor, snowblower, weed-whacker, or chainsaw to work and continue working, feed it ONLY ethanol-free fuel. That usually means Premium grade, and only from certain suppliers (Shell and Esso in Ontario. for example). Check for sources at https://www.pure-gas.org/

As of 2023 here in Canada our “we know better” Government has succeeded in eliminating our ability to purchase ethanol-free gasoline. It used to be that selecting Shell 91 octane (or 93 if you could find it) ensured that ethanol was not going to degrade the rubber fuel lines, pump membrane or contribute to corrosion in your carburetor and gas tank. (We have written a few times about the hazards of ethanol — search “ethanol” on Citroënvie). Although you will now have to deal with the additional maintenance issues that will inevitably result from using ethanol additive gas, we hope it does not deter you from getting out on the road to experience the refreshing difference of driving a classic Citroën.