PSA’s Riches in Europe Will Define its Global Strategy and Ultimately, the Destiny of Citroën

Recent financial announcements by PSA indicate that the company is considerably healthier today than it was when Carlos Tavares took over as CEO at the end of 2013. At that point, it was losing 3.3 billion euros annually, but by the end of

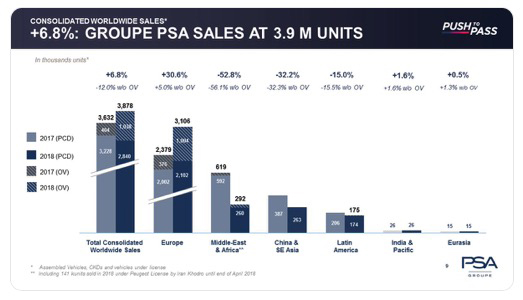

It must be said that lately, nothing seems to affect the group. Neither the prospect of Brexit – PSA has even seen its profitability on the British market double last year – nor the arrival of a new cycle of European homologation – Peugeot and Citroën gained market share in the last twelve months on the Old Continent, or even diesel engine regulations or the integration of Opel have derailed the Peugeot train, which can now boast the best ever historical financial results. “I think that never in our history had we had so much money in the bank,” exclaimed Maxime Picat, PSA Executive Vice President and Operational Director – Europe.

With our passion for classic Citroëns of the past century, we have been critical of PSA’s integration of the brand and the course the company has taken with many of its new models that are generally homogenized with corporate engineering. However, as with any corporation these days, the present and the future is all about the bottom line, and with these sales

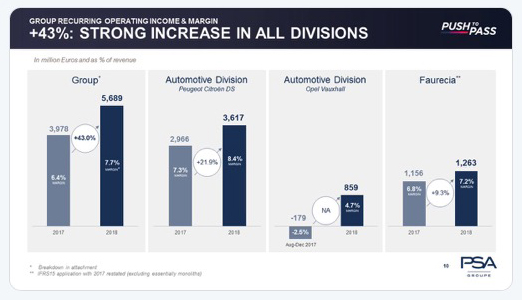

By adding Opel to PSA, the group’s turnover jumped 18.9% last year, to 74 billion euros (+ 5.6% year-to-year), with an operating profit of 5% – 7 billion euros. Its operating margin rose to 7.7% – more or less the level of Mercedes! All this despite a decline in PSA sales outside Europe – the forced withdrawal from Iran and softer Chinese sales in what is a growing and should be a stronger market (-32% in China and Southeast Asia).

Much of the profit can be attributed to reduced manufacturing costs and the load of the factories. This stems from the introduction of a platform policy were 70% of the parts are shared between several vehicles. Tavares boasts that “the break-even of the group has been halved in a few years.”

Tavares has decided to update his strategic plan for the period 2019-2021 by continuing the momentum he has initiated and trying to correct what is still wrong – starting with China. He intends to continue to reduce PSA’s model ranges, and successfully electrify to meet the European CO2 targets. By the end of the year, the small 100% electric Peugeot 208 and DS 3 cars will be on the market. And by continuing to make Opel more efficient, Tavares hopes to reduce his production costs by 700 euros per vehicle and limit the payroll/turnover ratio to 10% in 2021, compared to 11.1% currently.

PSA’s pot of gold objective in their corporate transition is to be the dominant player in a transformed automotive market that they predict will have a 10x increase in ridesharing by 2030 and account for 25% of the company’s profits. With 1.2 billion cars interconnected via IT technology by 2030, mobility will take on a new dimension in which PSA intends to have a significant stake.

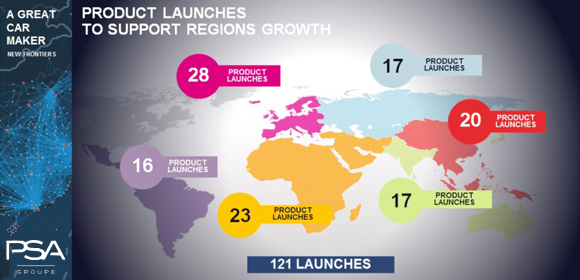

It would seem that PSA’s strategy is to pull up Asian sales and move into the USA while maintaining a strong position in Europe. And if these slides are any indication, it will be by pushing the Citroën brand to increase sales in India while re-establishing the Peugeot brand as they attempt to generate vehicle sales in the USA and Canada.

To maintain market lead and profitability in Europe, PSA as a whole will continue to market all their automotive brands. As far Citroën is concerned, the move is to still play upon the brand’s heritage as was shown at this year’s Geneva Motor Show where a classic B10, Traction Avant and 2CV were integrated into a display of current production models within a massive stand that definitely put the focus on new urban technology and mobility.

View the impressive stand at this year’s Geneva Motor Show here: