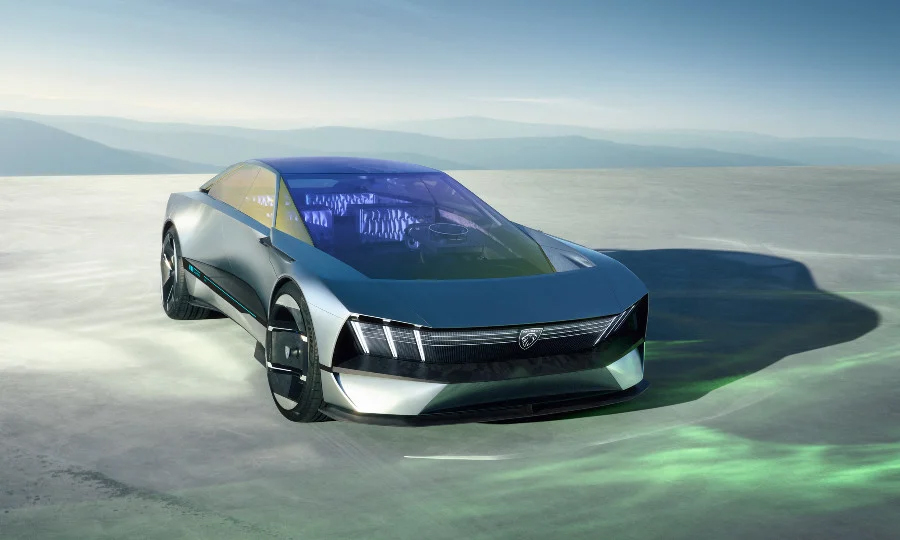

Stellantis CEO Carlos Tavares was at CES in Las Vegas on Wednesday unveiling two future vehicles; an electric “Ram 1500 Revolution” — a one-of-a-kind show vehicle that is the precursor to a production model due to be put into production at the end of 2024, and a Peugeot concept sedan called the Inception that the company says will inspire future models, some arriving as soon as 2025. His trip also touched on a few factors that give some indication as to the future of Citroën within Stellantis.

Tavares took the opportunity to further chastise Chinese auto manufacturers expanding into Europe with aggressively priced vehicles. He sees the European auto industry at a crossroads in competition with its Chinese rivals and warned that European politicians must help the region’s automakers compete with Chinese companies. No doubt his comments this week will further alienate Stellantis from sales within China.

On October 17, 2022, Stellantis announced that its Jeep brand would no longer be produced in China and that operations were being scaled back for the production of both Peugeot and Citroën in China.

Tavares stated “If politicians in Europe do not find an answer to the push into Europe by Chinese automakers, there will be a “terrible fight”. Europe’s auto industry could be forced to massively reduce its production capacity in the face of rising competition from China.” SAIC’s MG, BYD, Geely’s Zeekr and Nio are among Chinese automakers targeting European consumers with their electric cars.

Tavares added that the price difference between European and Chinese vehicles is significant. “If nothing is changed in the current situation, middle–class European customers will increasingly turn to Chinese models as the purchasing power of many people in Europe is decreasing noticeably.”

Europe’s emissions regulatory regime is not helping the region’s automakers, Tavares said. “Regulation in Europe ensures that electric cars built in Europe are about 40 percent more expensive than comparable vehicles made in China.”

“If the European Union does not change the current situation, the region’s auto industry will suffer the same fate as the European solar panel industry”, Tavares warned. “I think we’ve seen this movie before. It‘s a very bleak scenario. But it doesn’t have to go that way.”

Tavares outlined two paths the Europeans could take; “If you keep the European market open, then we have no choice: we have to fight the Chinese directly. And that applies to the entire automotive value chain. The consequences would then be significant. That would inevitably lead to unpopular decisions. Capacities would have to be cut and plants would have to be relocated to more favourable locations.”

Tavares was in India this past November saying that Stellantis is looking at lower-cost manufacturing in markets such as India and that Citroën is the brand Stellantis is banking on to grow there. India manufactured Citroën models (or those badged as some other Stellantis brand) could be the means to take on the Chinese in Europe.

The other path Tavares said, is to “re-industrialize” Europe. “Bring back lost industries and production chains. If you want that, however, there is still a lot to do in the EU and then you would need a different trade policy.”

While Stellantis has cooled on China, the German auto industry in particular would not be enthusiastic about a trade policy setting limits on China because it would massively affect their outcome having invested heavily in China to date.

And notably in the USA; Stellantis last month said it would indefinitely idle a Jeep assembly plant in Illinois, blaming the high costs of EVs for the decision.